Our Vision

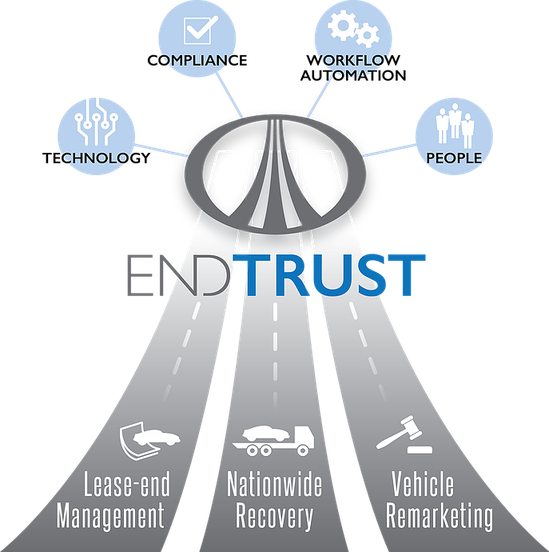

EndTrust is committed to building relationships with forward-thinking lenders/lessors as well as affiliate service providers who share a common vision for what our industry can be, not what it currently is.

EndTrust will always be a company of people doing business with people, however, we're laser focused on maximizing utilization of workflow automation and technologies that yield optimum operational efficiencies and effectiveness.

Since the inception of the CFPB (Consumer Financial Protection Bureau) in July 2011, compliance with protecting consumers has been vigorously pursued throughout the lending community. EndTrust stands in tandem stride with this government agency to protect consumers and all parties involved.